reit dividend tax rate

Ad Bold Trades on Real Estate - In Either Direction Bull or Bear. Put Real Estates Unfair Advantages to Work for Your Portfolio.

Best Reits To Invest In Real Estate Without The Hassle Story Invested Wallet

15 rate 10 rate in Bulgaria and Japan only if.

/AreREITsBeneficialDuringaHigh-InterestEra4-dbc06be2b2644060acc3bf1f7fe7aa37.png)

. The taxes that you as an investor will pay on those dividends. According to the National Association of Real Estate Investment Trusts commonly referred to as Nareit the dividend yield across all REITs was nearly 4 in November 2019. AREIT Ayala Land REIT Inc It is the first REIT in the Philippines.

Initial Public Offering of the company on Philippine Stock Exchange was August 13 2020. ROC is referred to as a reduction in adjusted cost base. In general the 20 percent maximum capital gains tax rate plus the 38 percent Medicare Surtax applies to the sale of REIT stock.

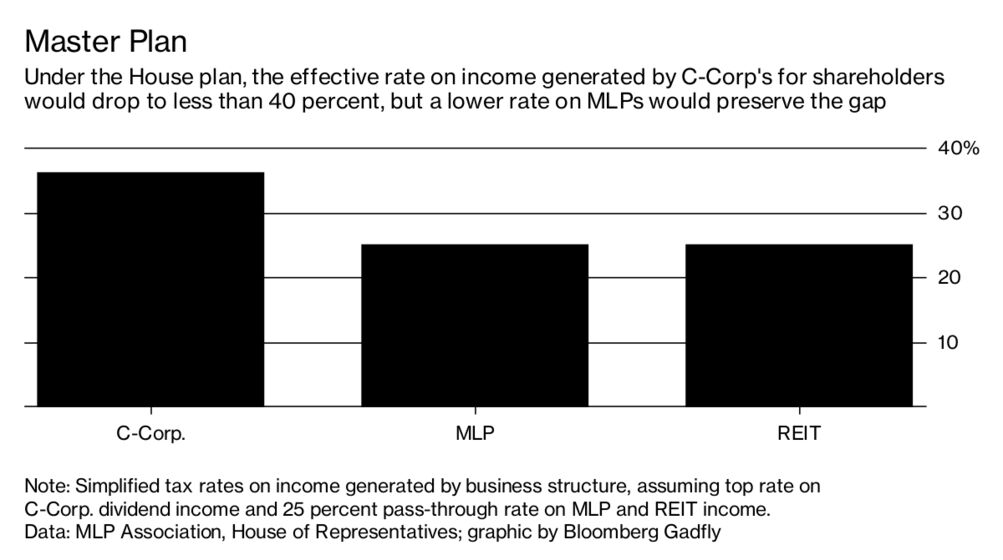

The majority of REIT dividends are taxed up. Direct access to a range of real estate investments including funds and our new REIT. These rate differences mean there is a.

A qualified dividend is taxed at a lower rate under capital gains tax rates. Become a member of Real Estate. What are the tax implications of your REIT dividends.

It requires a good stock tracking system. There is no immediate tax to pay on it as it simply reduces the cost of the share. Individual REIT shareholders can deduct 20 of.

Tax benefits of REITs. Heres a guide to help you find out. The REITs gross income consists of interest and dividends.

Please refer to the table below. The dividend is paid with respect to a class of stock that is publicly traded and. The dividends distributed to investors by a REIT can either be considered ordinary income or qualified income.

Learn More About How We Work Relentlessly To Create Opportunities For Our Clients. Instead the REIT withholds the basic income tax rate of 20 on your PID dividends and pays out the remaining 80 to you. REIT investors who receive these dividends are taxed as if they are.

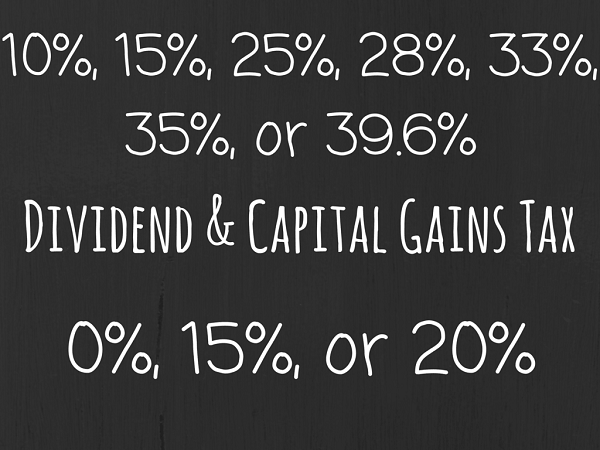

Current federal tax provisions allow for a 20 deduction on pass-through income through the end of 2025. The majority of REIT dividends are taxed as ordinary income up to the maximum rate of 37 returning to 396 in 2026 plus a separate 38 surtax on investment income. STAG Industrial STAG STAG Industrial STAG invests in industrial-use properties mostly.

Dividends from real estate investment trusts or REITs are considered taxable income in the eyes of the IRS but theres much more to the story than that. As of July 2021 its annual dividend was 228 for a yield of 586. Ad C-REIT from CrowdStreet reinvents the REIT for private real estate investors.

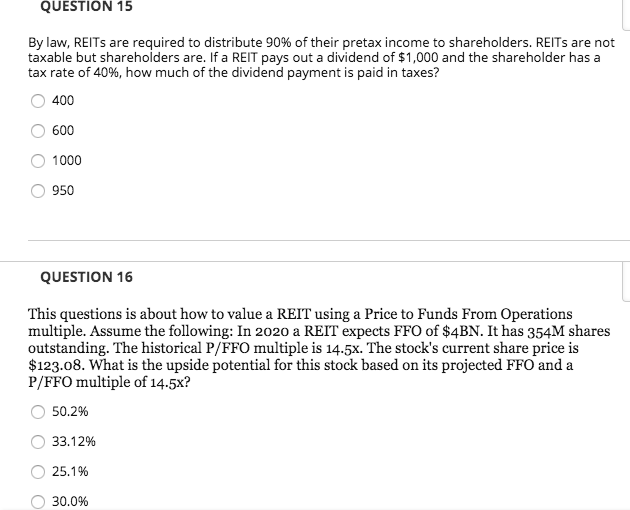

By law and IRS regulation REITs must pay out 90 or more of their taxable profits to shareholders in the form of dividends. PID dividends are not considered as part of your annual dividend. As of January 2 2013 the dividend and capital gains tax rate is 20 for investors making over 400000 and households making over 450000.

These tax rates typically range from 0 15 or 20 but vary by tax bracket. Ad Get Active Management With Real Estate Expertise Across Major Asset Classes Markets.

Real Estate Investment Trusts Tax Implications For Investors

A Short Lesson On Reit Taxation

How To Get The Highest Yield Out Of Your Dividends Morningstar

Your Financial Advisor Is Wrong About Reit And Bdc Dividends Seeking Alpha

Dividend And Reit Taxation Explained With Actual Examples Dividend Investing And Taxes Youtube

How Are Dividends Taxed 2022 Dividend Tax Rates The Motley Fool

Senate Tax Bill Sets A Trapdoor For Mlps Bloomberg

What Is The Reit Dividend Tax Rate The Ascent By Motley Fool

Dividend Stocks Vs Reits For Safe Cash Flow My Stock Market Basics

A Complete Guide To Reit Taxes The Ascent By Motley Fool

How Are Dividends Taxed Overview 2021 Tax Rates Examples

Question 15 By Law Reits Are Required To Distribute Chegg Com

Section 199a Qbi Deductions For Reits Vs Direct Real Estate

Can Dividends From A Reit Be Reinvested Tax Deferred

How To Pay No Tax On Your Dividend Income Retire By 40

Reit Taxation A Canadian Guide

Reit Dividends And Uk Tax Assura

2016 Dividend And Capital Gains Tax Rates Novel Investor

Sec 199a Dividends Paid By A Ric With Interest In Reits And Ptps